My son is addicted to art.

Big time.

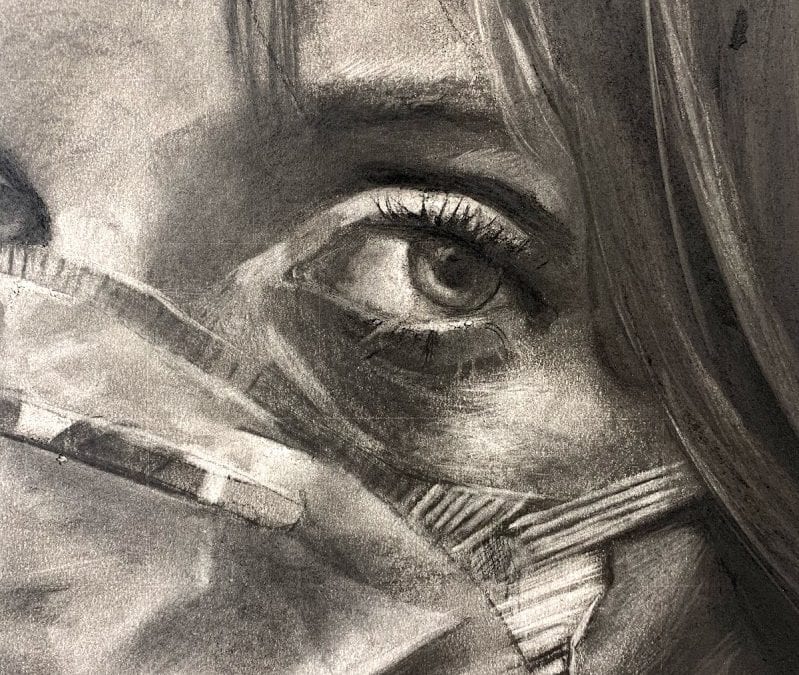

Turn your back on him and he’s sketching something, leaving trails of charcoal fingerprints in unlikely places, getting lost in his own space. Even since he was five, his art has been his bliss (and frustration).

Is his work of value?

Value?

Huge value. To me.

Let’s say that one day his works are of commercial value.

So, what’s changed between then and today? What magic has occurred? Why the lag between then and now?

Is it winning the Archibald Portrait Prize? Is it 1,000,000 likes on his Tik Tok channel? Is it a rave by Banksy. What has the ‘market’ recognised about his, or any artist’s work, that creates greater value?

Ok. Take a moment to consider your value as a financial adviser.

What’s the difference between your value and the value of my son’s, or any artist’s, work?

There’s lots, isn’t there. Too many to list. Sure.

But, there are similarities too.

Isn’t the value for your advice just as a subjective decision as the value of an artwork?

Put it this way, if that first advice client who said “yes, let’s engage” never said that, you’d be like the out-of-work artist making the coffees at the local cafe. Agree?

So, from that perspective, advisers and artists are similar in that their worth comes from those they appeal to.

Worth?

How do we as advisers know what our worth is?

The profit and loss? The amounts on the commission statement (do you still get one of those)? The bank balance? The waiting time for an appointment? The new enquiries? The amount of work in progress?

None of those really.

Being human, we best know and feel our worth when clients tell us how significant or meaningful our role are in their lives.

It’s subjective.

If you believe that there’s an element of subjectivity in the worth your client’s attach to your services, here’s the point – do you really believe your worth to your clients today will be of more worth to your clients in three years time?

While your best clients today probably won’t be your best clients in three years time, surviving and thriving beyond Covid-19 is less about embracing the clear technology lessons, and more about understand how you are going to be of more worth to your clients in three years time.

Today is really a time to review and reflect ahead of the inevitable surge for quality advice.

Advisers could do much worse than review Everett Rogers’ Diffusion of Innovations to see how these times align with his thesis of four criteria for lasting change – i.e. innovation, channels, timing, and social systems.

Just as ‘Post Covid-19’ will become a way-point similar to ‘post-9/11’ and ‘post-Depression’, the way-point all advisers are in today is a time to wisely consider what will be the subjective worth of your services for the clients you hope will be growing your business in three years time.

Our clients, our teams, our society, our habits and our worth will not be the same again. Let’s make them all better on purpose, rather than just relying upon hope.

There’s another similarity between artists and advisers.

They are often perfectionists, which doesn’t always make them the best business-people.

There’s another difference between artists and advisers.

Artists usually are not in it for the money. Like my son, he is just drawn to draw, regardless of reward.

It’s both fantastic and tragic.

But that’s life isn’t it?

What do you reckon?

Photo Credit: @frartstack

ABOUT JIM STACKPOOL

For over 30 years Jim has influenced, coached, and consulted to advisory firms across Australia. His firm, Certainty Advice Group specialises in building advice firms who charge flat fees for comprehensive, unconflicted advice. He is growing a community of advisory firms who align with Australia’s highest and only ACCC/IP Australia Certification Mark standard of comprehensive, unconflicted advice – Certainty Advice. He is also an author, blogger, and keynote speaker.