My eldest daughter loved her first job.

It was in our local video store during her last years at high school.

Way back, she was always the one we had to drag out of the place by the collar of her Wiggles dressing gown every family video night. Her joy working there wasn’t the pittance of pay (thankfully she still adores the arts more than money) but hanging out with other local trainspotting tragics sharing their quirky, encyclopedic knowledge about arty movies and conspiracy theories. Something they couldn’t get from Netflix.

It wasn’t about the product on the shelves for them.

Then again, is it ever about the product on the shelves?

It certainly was for some financial advisers heaving thankful sighs of relief on the news the Liberals had won the unwinnable election. The relief was due to grateful return to normal operations as threatening Labor party franking credit, and negative gearing election pledges might stymie their Self-Managed Super Fund (SMSF) revenues. Their comfort may still be a false positive for future SMSF revenues if they continue to ignore what killed the video stores.

Consolidation isn’t new

Is there a Netflix moment coming for financial advisers?

Advisory group Countplus believes so with conclusions that planning and accounting will consolidate. This isn’t new for accounting firms, planning firms and financial product providers.

However, this time the driving forces are different.

Significantly.

The returns from previous ‘one-stop-shop’ consolidated models grew not so much from excellence in client advice but courtesy of a superannuation system that not only allows the consolidators to take low-risk, one-way bets using consolidated client’s superannuation and investment monies, but actually incentivised them to flog (i.e. they preferred the term “cross-sell”) more financial products.

These consolidations were in an era ten years ago when the retiring head of Westpac, David Morgan, was claiming that the opportunities from wealth management were the greatest he’d ever witnessed in his distinguished banking career. To date, Westpac has estimated $260m remediation costs for excesses identified in last year’s Royal Commission and face another $300m in restructuring costs as they slash most of their 803 advisers at the end of this month – a misunderstood rather than a great opportunity in retrospect.

There were many reasons why few of the past consolidation models still exist today. However, there are learnings from the experiences of the glory days of Professional Investment Services, Stockford’s, Harts Australia, Count, Charterbridge Group, Deakins and others – particularly the questions to ask and listen for when seeking financial advice.

Accountant or Planner or Adviser?

In the wash-up of the Royal Commission, as firms consolidate, as the financial product industry is Netflix’ed, as functions and titles blur, who will Australian’s approach to assist their financial future?

An asset manager? Broker? Property agent? Tax agent? Accountant? SMSF specialist? Aged Care adviser? Financial planner? Financial adviser? CFP? CPA? CA? ICA? Insurance adviser? Mortgage broker? Bank planner? Industry fund adviser?

Houston, we have a problem. Finding the right advice isn’t getting easier.

Improvements for seekers of advice are happening. Not so long ago it took longer to get the new business cards printed than it did to become an ironically named ‘proper authority’ after only an improperly short four intensive days.

What can be learned from the shifting advice offerings as current advice models stagger?

It depends.

However, one advice trend seems to be clear.

The title, i.e. planner, banker, adviser, agent, accountant or specialist, might not assist in the selection, meaning the first steps for advice-seekers need to be deliberate.

If what’s sought is a specific product or service, e.g. an SMSF, a property, a tax return, or selection of investment; many of these product-specific services are being commoditised with consequences as widespread as the video store experience for product providers. There will be a minority of Australians that need specialists on specific financial subject-matter to untangle the complex cases for expensive fees, but these will be over-kill for most Australians most of the time.

For the common queries, many of today’s offerings will follow the video stores being replaced by services such as barefootinvestor.com that are quickly becoming the new go-to’s for the majority of those seeking understanding on specific services – long may they grow and reign.

However, the Achilles heel of the services such as barefoot investor is right there on their web page “…information provided is general in nature”.

So, if someone doesn’t know what specific product or service may be the best next step in their financial lives, where do they start?

Value.

Start with Value

The first step when starting with value is the clarity regarding what is of value.

This clarity does not come from conversations about money, but discussions about value, your value. The financials are only a means or enabler to achieve and maintain a lifestyle, objective or outcome of value to you.

For instance, getting more confidence in your financial life might be the value you seek or getting the structure and support for needed changes regards your financial life might be of value.

Having an understood path that best achieves outcomes meaningful to you, or overcomes financial blockages that continually frustrate you, might be the value you seek.

Re-aligning your busy life with your neglected financial life by providing the needed means and support to ensure your dreams are more than quiet hopes or slim luck, might be of value to you.

These are regular conversations with people who can assist you in achieving your value.

Consistency is crucial because what we value changes. Regularly re-starting and re-aligning any financial relationship to start with what you value is neglected by today’s financial experts who focus more on their technical value than the personal value being sought.

Due to today’s remuneration models for most advisory functions – i.e. hourly or product based – the value conversation has been a ‘sales-tactic’ rather than foundational for every financial advisory relationship.

So, listening or being asked questions about the value sought is an excellent first step.

The second step to starting with value for those unsure what they require is ensuring your advice provider is only getting paid by you, and the costs of their engagement are expressed in dollar amounts.

If there is any other influence or incentive received by your advice provider that creates a potential for conflict, the ensuing trust will have fractured foundations weakened by conflict. Unfortunately, even when such conflicts are disclosed, the consequences are not always appreciated.

We will always need tax advice, investment and superannuation returns, risks minimised, debts leveraged, cash flows controlled, and life’s stages transitioned. The technology that overpowered the video store is transforming these essential services into more accessible and affordable commodities to change forever what we have understood financial planning, accounting, banking, brokering, and wealth management to be.

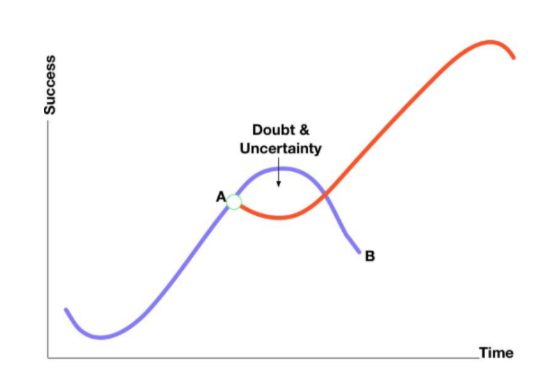

In retrospect, the demise of the video store was foreseeable. Promising experiences while being remunerated on product rentals was a mismatch plump for a disruptive Netflix and others.

So too with how we will purchase our financial services as they approach their Netflix moment.

As technology provides us with more options, as existing models stagger or consolidate, the value you ultimately seek will reign supreme. If seeking out relationships with advisers to support your financial life, seek out those that consistently understand and position the value you seek at the heart of everything they do for the transparent fees you pay.

What do you reckon?

About Jim Stackpool

For nearly 30 years Jim has influenced, coached, and consulted to advisory firms across Australia. As founder of Certainty Advice Group, he leads a like-minded team of professional advisory firms seeking to create greater certainty for their clients. As an author, blogger, columnist, and keynote speaker, Jim is regularly called upon for his professional insights into the advice industry. His latest book Seeking Certainty is available now.