What Warren Buffet is for investors, Abraham Maslow is for financial advisers.

But it’s easy to forget that in these weird times.

I certainly didn’t grasp the power of his theory of motivations forty years ago packed up the back of a crowded Carslaw lecture theatre.

CRISIS & MASLOW

Winston Churchill quote of “…never waste a good crisis” provides a clue as to what Maslow can provide to client’s conversations.

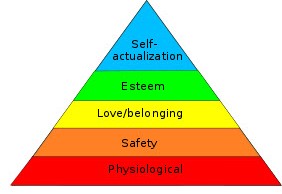

Basically, COVID-19 has collapsed Maslow’s hierarchy of needs.

Everyone’s.

Right now, we care less about our desires to travel the world, plan for our retirements, or upgrade our homes.

That’s all been replaced.

Our motivations are now centered on the basics of life: about our food supplies, access to toilet paper, paying our bills, keeping our jobs and businesses open, living with restrictions never seen and the health of those important to us.

Using Maslow’s frameworks, we’re all experiencing a crisis in our fundamental needs. And our crisis is unique to each of us.

What to do as advisers?

ADVISORY MESSAGES

Advisers are encouraged to reassure their clients.

The suggested messages range from ‘this will pass’ to ‘we have seen market collapses before’ to ‘up and downs are inevitable, our long-term planning is still good’ or ‘everything will be OK’.

Obviously by their nature crisis come and go, but I predict this crisis won’t bode well for those messages as they misunderstand Maslow’s theory on what we value and motivates us, particularly long-term.

I wrote in different but similar times, where were the queues of clients flocking to their advisory firms (or virtual Zoom sessions)? Why aren’t financial advisers sought out by majority of Australians similarly to medical advisers, as their first point of contact for today’s fundamental financial concerns?

There are always exceptions, but when it comes to a crisis of fundamentals, most Australians are not turning to the financial advice industry for their most urgent of needs in these times.

BEST ADVISORY STEPS

Maslow’s framework provides the clues.

He proved that we are wired and motivated to achieve our unique higher needs. This is the core of Maslow’s theory, the essence of what motivates us and what we value. His theory is that value is not something we provide as advisers – value is something the client experiences as a consequence of our advice, our relationships.

If we heed Churchill’s advice, our best advisory steps go beyond the thin messages of reassurance.

Our best advisory steps are deeper conversations, potentially insisted upon, to ensure our advisory firm is making no assumptions about the role and advice required to provide the value each client needs right now in their times of fundamental crisis.

These conversations are more than re-confirming their asset allocation for better investment returns or opportunities to buy under-priced stock, more than getting access to available government support funding, more than revised cashflow plans considering worsening employment or job security. While possibly important, these steps are not the urgent ones Maslow would recommend.

Maslow would suggest these steps are only that – steps.

He would hope we as advisers would be having deeper conversations with each of our clients to identify and more importantly understand their specific higher needs and value that our expertise will maximise all probabilities of them achieving.

Hopefully these times confirm for all advisers that if their firm can methodically, specifically and consistently understand the higher needs and value each client is always seeking, they will not only navigate their clients and their firms through this crisis of fundamentals, they will build some of the great advisory brands of the future.

More importantly, this will alleviate the real anxieties and uncertainty experienced by Australians not only for this and future public crisis, but also for their client’s on-going more personal, often unknown, and equally fearful crisis.

What do you reckon?

Image_Credit: wikipedia

ABOUT JIM STACKPOOL

For over 30 years Jim has influenced, coached, and consulted to accounting & financial advisory firms across Australia. His firm, Certainty Advice Group specialises in growing professional advice firms offering comprehensive unconflicted advice. He has created Australia’s highest and only ACCC/IP Australia Certification Mark standard of comprehensive advice – Certainty Advice. He is also an author, blogger, and keynote speaker.