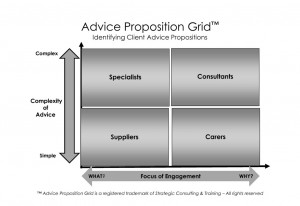

Now let’s refer to the Advice Proposition Grid that we use with the financial advisory firms that use our business consulting.

Simplistically, the Advice Proposition Grid attempts to define four broad advice propositions.

Importantly it is expected that professionals acting professionally will deliver each of the four propositions. It’s not which proposition is delivered that defines whether the adviser is acting professionally. Defining professionalism involves ensuring that the engagement intents of the adviser and client are consistent, aligned and understood.

The four propositions are defined on the basis of the complexity of the adviser’s financial advice proposition and what the client’s focus, or reason for engaging their adviser is.

Defining complexity means different things for different firms, but generally, for example, transferring $20,000 into a superannuation account might be considered simple. Whereas helping a client who is over the $6million asset limit to do some company dividend payments, super contributions and property transfers, while dealing with multiple ownership issues, might be considered complex.

It’s trickier to agree what the client’s focus or reason for engaging is. (I’m a fan of Simon Sinek’s thinking on this approach. Check it out at www.startwithwhy.com and click on the TEDx link).

If during engagement conversations with your client, it emerges that their main intent is to just get a better return on their investments, or to rollover some monies, to get their tax work done, or to pass on the family firm to the next generation, then they’re seeking assistance with transactional jobs where the adviser performs either a Supplier or Specialist role, depending upon the complexity of that transaction.

The professionalism of Supplier and Specialist work is determined by what was done (e.g. the tax return, the sale of shares, setting up a self-managed superannuation fund, or transferring business ownership).

However, if engagement conversations with your client unearth and focus on desired outcomes rather than the means by which these outcomes will be achieved, then the adviser will perform a Carer or Consultant role, depending upon the complexity of engagement.

The professionalism of Carer or Consultant work is determined by how it better assists the client to achieve their desired outcomes.

Usually Supplier and Specialist work is shorter term than Carer and Consultant work.

Usually Carer and Consultant work involves more client behavioural management over a longer period of time than Supplier and Specialist work.

So, let’s consider some professionalism questions using the above client value proposition definitions.

If the client’s intent is to purchase a Supplier or Specialist proposition from a financial adviser, is it professional for that adviser to be paid via a commission?

However, before I can answer that question I need to understand whether the focus of both the client and adviser are aligned.

That is, are both client and adviser clear that this is a transaction, that once done, the client’s issues are addressed and they don’t perceive the need, at this stage, for further engagement?

Assuming adviser and client are aligned and agreed that the focus is on this event or set of transactions (e.g. just set up the self-managed super fund, just help us sell this business, just do the tax return), then I don’t believe it is any less professional for the adviser to be paid via commission than it would be for a professional car salesperson or professional real estate agent.

The only proviso I would add if commissions are to be charged is that the dollar amount and commission rate should be clearly disclosed (and by clearly I mean the type of clear disclosure we now have in Australia on cigarette packets, i.e. “in your face” clarity).

Thanks to the underlying DNA of most financial services transactions today, the inevitable follow up professionalism question will be a significant sticking point for many financial services professionals.

Namely, if the intent of the client is to purchase a Supplier or Specialist proposition but the adviser engages and charges with the ongoing intent of providing a Carer or Consultant proposition, is that considered professional conduct?

The knee surgeon doesn’t continue to receive fees in the years after the surgery. The real estate agent doesn’t continue to get paid a trail fee in the years after the sale. Neither should it be deemed professional conduct for the adviser to be paid ongoing for a transaction or event handled years before.

What about the ongoing review of a client’s insurances, investments and tax situations?

These are just more ‘events’ that will be charged for in follow-up Supplier or Specialist engagements when the client’s needs warrant it, just as clients are charged and engage now with their dentist, their doctor, or their accountant.

This situation is the heart of the “default opt-in campaign” – whereby advisers do not need to secure a bi-annual (shouldn’t it be annual?) agreement with their clients to opt-in to ongoing payments – which is currently being championed by industry associations and others.

Do you think “default opt-in” is professional?

About Jim Stackpool

For nearly 30 years Jim has influenced, coached, and consulted to advisory firms across Australia. As founder of Certainty Advice Group, he leads a like-minded team of professional advisory firms seeking to create greater certainty for their clients. As an author, blogger, columnist, and keynote speaker, Jim is regularly called upon for his professional insights into the advice industry. His latest book Seeking Certainty is available now.