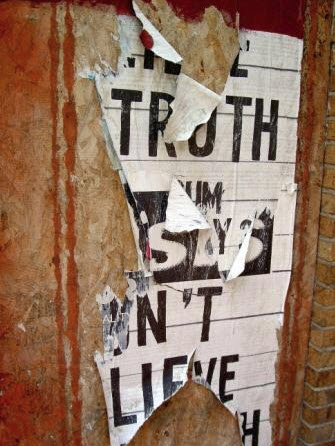

“A lie told often enough becomes the truth.”

Lenin, Russian Communist politician & revolutionary (1870-1924)

There’s been a great big lie bouncing around our industry for some time.

I can picture a group of really clever product guys and girls brainstorming various strategies to differentiate their soon-to-be-launched product. It probably happened about the same time as investment products came onto the market, allowing advisers to dial-up or dial-down commission or trail rates. Wow, what flexibility that created.

Anyway, the story goes something like this.

Our industry is broken up into three main parts:

- Distributors of product. These are the good people who actually go face-to-face with their clients. The job of the distributor is to listen to client issues, gather their facts, discuss their options, present a (compliant) plan, and implement an appropriate solution.

- Manufacturers of the products. These are the people who make the products. From sharp-witted actuaries (you know, the ones that actually look at their own shoes as they introduce themselves), to asset consultants and everything in between. Their job is to build the appropriate products that the clients will buy.

- Administrators of the products and services. To name just a few participants within this increasing group – there are the suppliers of the platforms, custodians, dealer groups, and technology providers.

The big fat fib is that the manufacturers and administrators will bear the full brunt of inevitable future price pressures, while the distributors will be shielded. Distributors will supposedly be less exposed because, being at the front of the transaction (i.e. with the client), they offer the advice which the client will value the most.

What’s wrong with that?

Plenty. Well at least a couple of things.

Firstly, it doesn’t bear much resemblance to the reality of what is happening in today’s marketplace.

Most adviser firms today don’t charge up-front for their advice. (Only 7% of all income is collected in up-front fees according to our own Dashboard™ Reports – Australia’s largest audited database of productivity, profitability and performance data benchmarking the financial planning/advice industry. Dashboard is a registered trademark of Strategic Consulting & Training Pty Limited).

That is, most advice firms prefer to discount, or give away their upfront advice in the quest to gain the product sale and the associated ongoing revenues. So why are they even called advice firms when they don’t charge for it? Beats me? The big problem for most of the industry is that they are giving away their most precious, differentiating commodity – the advice.

Secondly, the fib presumes that the distributors CAN set the price they charge.

Sure they can, but do they? Nope. So despite the manufacturers (and possibly administrators) believing their price will be commoditised quicker than the distributors’ prices, the fact is that the majority of distributors can’t even set the price for their services.

Only a few distributors have deliberately built the crucial pricing muscles necessary to compete on the even playing field of competition. Without pricing experience, they will always be consigned to be a price-taker (as dictated by the product manufacturer) rather than a price-maker. I don’t know about you, but my thoughts are that if you run a business where you don’t control your price, you’d better get along real nice with your product suppliers. Don’t worry, they’ll look after you. Yeah right!

Before I hear from the born-again fee-only brigade, I challenge that your pricing is still intrinsically linked to product provided rather than the services provided. Before I hear from the hourly rate fanatics, I challenge that has never been and never will be a model that identifies the true professional. No, hourly rates models need to be dumped just as quickly as product based pricing.

But then again, a good lie seems to have more legs than some hard work on pricing your work based upon a varying combination of work done, expertise provided, risks taken, experience, advice delivered, and resources involved. Pricing is both art and science. Only at the commodity end (think hamburgers) is the price set. Just because it’s hard to price right, doesn’t mean that we – as an industry – should continue to price wrongly, based solely upon product provided.

These are the best of times to prove yourself as a price-maker. Happy are the price-makers, for they will inherit the future prosperous advice space.