People don’t want more choices – they want to be more confident in the choices they make.

Read NYU’s Professor Galloway’s musings?

Easy read, makes sense, consistently clarifies some things for me.

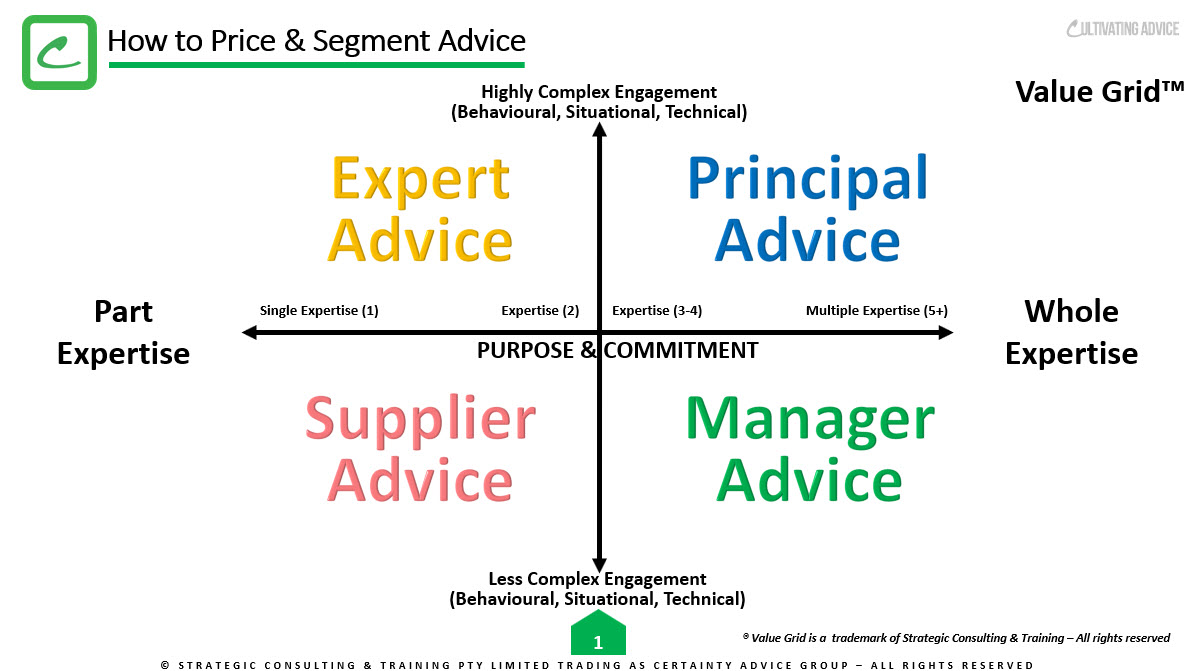

I’m presenting a model of advice in this blog.

It’s for clients and advisers to potentially help understand the type of advice needed or provided.

Since the release of FASEA’s Code of Ethics (this is now law) covering the delivery of most financial advice in Australia, there is considerable confusion, and understandable objection, about the implementation of parts of the Code.

As we patiently await the appointment of the new ‘Code-enforcer’, we have some relief aware that our incumbent, over-stretched and under-funded regulators have promised to take a ‘facilitative’ approach with the new Code for the time being.

But we need models to assist our thinking and approach. Here’s mine.

NEW MODEL

There are two axis (see diagram).

The vertical axis is logical – it’s complexity.

Why complexity?

Because advice is only needed when one is faced by a complexity that can’t be solved without some input.

Really complex issues (whether technically, situationally, behaviourally or a combination) is at the top end. With not so complex at the bottom end.

Capiche?

The horizontal axis is the new bit – it’s purpose.

In fact, It’s much more than just the purpose of engagement, it’s also commitment.

Purpose without commitment can make purpose more of a sales gimmick for elevator pitches and closing conversations. So, here Purpose is a combination of Purpose and Commitment.

But whose purpose?

Everyones.

And for what purpose?

Serving the Whole or Part.

What?

SOME EXAMPLES

Let me explain.

Assume you, as a client, have the sole purpose to seek advice about the best possible investment for you. Put another way, the only PART of your whole financial life you want advice on is about investments.

Nothing else.

Assuming you’re a vanilla-type of client, you’re uncomplicated, not after anything fancy, don’t have a life partner with co-ownership of joint monies or different views. Your purpose is just simple good investment advice.

In my model – this is an example of Supplier Advice.

Now assume a different example.

Say the example above now has a partner who jointly owns the money for investment.

But in this example, both partners have strong and totally opposing views as to what investments are appropriate for their money. Also, one partner wants to sell out and retire from a small business, as well as transfer a significant inheritance from a late parent’s estate in Germany – things are getting a little more complex.

This decision might now be considered Expert Advice.

Both examples are about one PART or one product (i.e. investments)within the client’s whole financial life.

Different levels of expertise are required due to different levels of complexity for both advisers and clients.

Importantly, best practice and compliance dictate that broader elements of the client’s lives are considered, but the value being sought by clients is essentially Supplier or Expert Advice on one, maybe two PARTS of their financial lives only.

Making sense so far?

COMPREHENSIVE ADVICE

Consider the right-hand side of the diagram.

Here the purpose and commitment of the advice are to serve the whole client.

An extreme example.

A generous hard-working couple, one a part-time teacher, the other a partner in a legal firm, were hoping retirement was close.

Their frail aging parents have worsening dementia needing new living arrangements sooner rather than later. The best and most convenient aged care facilities are beyond available funds and already have lengthy waiting lists.

Their eldest daughter, with two of her own children, is hoping to move back to the family home due to emotional and financial chaos since her partner left them.

The wife’s legal firm has been losing fees since a split with junior partners. Her legal partners are seeking to raise funds from each partner to hold onto staff and fund new directions.

What’s the best path forward?

Ah, it’s complicated and probably needs Principal Advice.

The final example.

Another couple, young kids, a huge mortgage, both working hard, finding it difficult to save.

They don’t have many arguments but when they do, it’s about money and more specifically their different spending habits.

Their relief?

Every time they meet with their adviser, they re-discover that they still have options, good ones. They find there is solid ground in their financial lives, and most of the fears they fought about had little probability of eventuating.

Peace of mind advice – good manager advice.

What do you think?

Obviously in real life, we all drift between all these models at various times of our lives.

FUNDAMENTALS

Regardless of the model, the fundamentals are still crucial.

All advice must be impartial and in the best interests of clients every year.

There can be no misaligned incentives influencing the advice provider –only the client seeking the advice can be remunerating the adviser if you seek enduring streams of advice fees.

Amounts are charged in terms everyone understands – flat dollars or retainers.

Again, Prof Galloway’s message: People don’t want more choices, regardless of the type of advice sought, they seek more confidence in the choices they make.

Financial advice will always mean different things to different people at different stages of their lives.

There are various models of advice. These models aim to further the debate of what is the purpose of financial advice, to cut through the marketing messages, to reduce distractions of more inevitable scandalous headlines, and move on from former models of advice that have not served enough of us.

But, fundamentally, the debate about advice is necessary and needed.

For both client and adviser, it starts with the question of purpose. Purpose then defines value.

Long before Justice Hayne’s final report, the financial advice conversations of past decades have been hijacked by product manufacturers, big and small, deliberating masquerading a product sale as advice.

Unfortunately, it continues today.

Understanding the types, importance and differences between advice models hopefully helps more Australians access the advice they value.

What do you reckon?

ABOUT JIM STACKPOOL

For over 30 years Jim has influenced, coached, and consulted to accounting & financial advisory firms across Australia. His firm, Certainty Advice Group specialises in growing professional advice firms offering comprehensive unconflicted advice. He has created Australia’s highest and only ACCC/IP Australia Certification Mark standard of comprehensive advice – Certainty Advice. He is also an author, blogger, and keynote speaker covering topics on his expertise.