OUR APPROACH

Everything we do starts with value.

We never assume what is value for every client as it means different things to different people at different times.

This is the heart of the methodical, consistent and specific approach that is Certainty Advice.

CERTAINTY’S THREE PRINCIPLES

No Conflicts

Firstly, the only remuneration or benefit for advice is paid by each client. There can be no other perceived, real or related-party benefits that may serve the interests of advice-providers ahead of the best interests of each client.

Principal Advice

Secondly, Certainty Advice is comprehensive or Principal Advice. We believe the cure of a part should not be attempted without the treatment of the whole financial life. Again, this ensures the client’s best & comprehensive interests are served.

Valuable Fees

Thirdly, Certainty Advice needs to be priced in dollars. People understand dollar amounts and are better able to determine value when priced simply in dollars. The fee needs to be based upon value being achieved by each client, not amount of hours or products provided.

CERTAINTY ADVICE – An Australian First

Certainty Advisers adhere to Australia’s first Certification Mark (#1755914) for professional advice.

Jointly issued by Australian Competition and Consumer Commission and IP Australia, the Certainty Advice Certification Mark provides clear boundaries ensuring the three core principals of Certainty Advice are maintained by all our certified Advisers.

Certainty frameworks

Nothing builds frameworks better than experience

Every Certainty Framework starts with the same intent – to deliver the value clients seek.

Google has their ‘secret’ search algorithms, Coca-Cola has their ‘secret’ drink formulas and Certainty Advice has it’s own certified approach to consistently, specifically and methodically understand the value our clients seek. We do this every year to ensure we don’t go off track.

Examples of the Certainty Frameworks

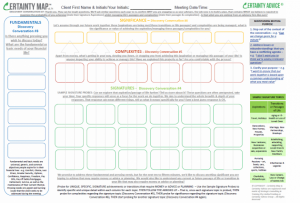

CERTAINTY MAPS

Certainty Maps capture why clients need, take, value and pay for advice. Designed for face-to-face meetings, or online use, these frameworks capture the unique value each client seeks.

Mastery of these frameworks is by a commitment to developing listening, probing, facilitating skills, knowledge of seven conversational elements – Positioning, Fundamentals, Signatures, Complexities, Significances, Transitions, Aspirations, and acceptance of consistent critique for improvement.

CERTAINTY TERMS OF ENGAGEMENT

The Certainty Terms of Engagement is a 3-4 page framework used to gain a client’s commitment to engage for twelve months. It starts with the essential component – the specific value sought by the client.

It also outlines the recommended high-level approach in priority order, the proposed annual fees in dollar amounts, and payment terms over the twelve months.

These documents contain no specific product or product-related recommendation – detailed recommendations will be provided in technical documents developed after the annual advisory relationship has commenced.

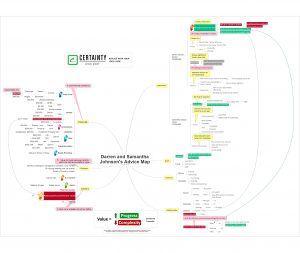

CERTAINTY ADVICE MAPS

“The cure of a part should not be attempted without the treatment of the whole” – Plato.

Certainty’s Advice Maps display the client’s financial life on a page. They provide the ‘big picture’ for clients, helpful for clients who prefer to deal with ‘pictures’ rather than ‘words and numbers’.

These Maps become a central management tool in the relationships between Certainty Clients and their advisory teams.

Produced initially and updated before each important review meeting, Certainty Maps do not show every detail of the client’s financial life. Their focus is on four areas – the value, the priorities, the progress and the issues.

CERTAINTY ADVICE PATHS

“What will your advice provide, what are the steps, and when can I expect some real progress?”

Certainty Advice Paths pictures each client’s unique forward path. Advice Paths depict the timeframe for managing future transitions, achieving future aspirations, and addressing specific complexities alongside the recommended approach.

They show up to 7 years forward. For existing clients they also include the significant progress already achieved.

CERTAINTY WORKFLOWS

Certainty Workflows provide the detailed process flows of the Client Discovery and Engagement approach.

Built upon two decades of reviewing Certainty Discovery and Engagement conversations for thousands of advisory team meetings with Certainty Clients, the Certainty Workflows provide advisory teams with detailed conversational guidelines.

They serve as important training, support and integration tools for advisory teams to update, customise and develop their own internal workflow methodologies and threads.

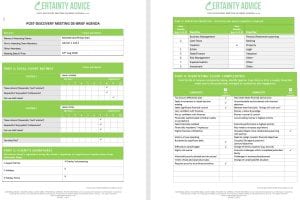

CERTAINTY DEBRIEFS

Methodologies are as strong as their weakest link.

Certainty DeBriefs strengthen the link between productive Discovery meetings and efficient (re-)engagement. The framework provides the agenda for the 20-minute post-Discovery meeting in which the advisory team create first draft of new (or renewed) terms of engagement.

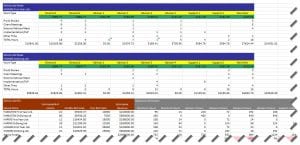

CAPACITY PLANNING MODELS

The Certainty capacity planning models ensure client engagement agreements are priced not only on value but capacity to deliver.

Based purely upon external precedents that are not without consideration of an advisory team’s capacity, pricing will significantly affect the firm’s ability to fund sustainable growth while potentially placing significant pressure on critical resources.

WHY ADVISORY FIRMS ACHIEVE MORE WITH CERTAINTY

Why Clients achieve more with Certainty

THIRD-PARTY BUSINESS PARTNER FEEDBACK

There is too much misunderstanding about what clients pay for. The value of Reine‘s flat fee is clear regardless of the type of advice he provides.

It’s about taking a client as you find them, not trying to push a product. Relief best describes our client’s feelings re working with Scope.

I’m protective of who I refer my clients to. Their approach is from the ground up which ensures the best outcome rather than a top-down loading of ‘this product is best for you’