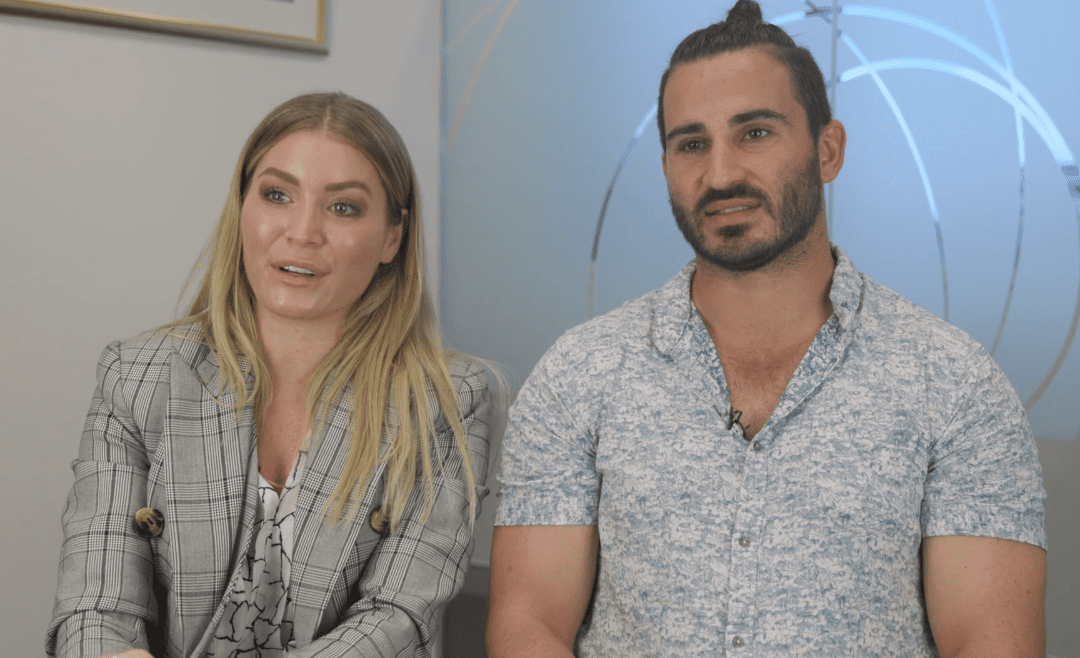

Katie and Tim are clients of Reine Clemow and his right-hand-lady Donna Loverick at Acquira Wealth Partners in bustling Southport.

You know what struck me listening to them?

Katie and Tim were very informed, aware and particularly certain of one thing.

They didn’t want to deal with an adviser (or using Katie’s language – ‘mentor‘) that had any “strings” attached to advice.

No trail fees, no commissions, no product-based income or no form of remuneration taken by their adviser that might influence the advice. Because, as Katie said, this demonstrates that Reine and Donna totally back their advice – and that’s how it should be? Shouldn’t it?

It is how it should be.

It is how it will be.

But – it isn’t how it is at the moment.

Today, what’s referred to as ‘financial advice’ regarding your superannuation, your investments, your insurances, your mortgages isn’t the financial advice that Katie and Tim are seeking.

Its usually advice about a product.

Which doesn’t make it bad advice, provided you know what you most need.

It’s obvious from our filming session that Katie and Tim have lots on. They lead busy lives. It was also obvious how focussed, excited, and realistic they are about their opportunities and challenges.

But they also honestly acknowledged that they didn’t know exactly what they needed to do financially.

It was a bit of a “congratulations-you’re-normal” moment.

They value the support for their best possible steps forward to ensure the best returns, least wastage and peace of mind that all their hard work and focussed efforts will be worth it.

Paths not Products

Reine and Donna are providing them with a path, unique for them, that leads them forward that best meets their needs.

What does this mean for any of us currently paying for or seeking financial advice?

Product advice and financial advice are not the same.

Don’t be fooled by anyone that suggests there’s no difference.

Katie and Tim seek financial advice in a ‘partnership’ with Donna and Reine.

They knew they wanted an advisory firm that backed and got paid on the quality of advice alone, not attached to specific products.

Be wary of any service labelling itself advice but the advice, value and pricing conversations are all about what a product will do rather than what your adviser will do.

The origins of the financial planning and advice industries mean most of us make our financial advice purchase decisions the wrong way around.

It’s like selecting a vehicle based solely based upon the features of the engine.

We buy self-managed super funds, or shares, or insurances, or mortgages on product merits thinking we’re making sound decisions.

The advantages of Katie and Tim’s approach is they pay for advice based upon the value.

Value is Advice, not Product for so many

They aren’t paying for any product advice because that isn’t the value.

Importantly Katie and Tim see Reine’s approach as consistent with their own sense of what is valuable.

The biggest challenge for most of us is the paradigms in our heads as to what is valuable financial advice.

The more we hear from people like Katie and Tim’s experiences with great advisory firms like Reine’s, the more of us will understand what valuable financial advice actually is.

What do you reckon?

About Jim Stackpool

For nearly 30 years Jim has influenced, coached, and consulted to advisory firms across Australia. As founder of Certainty Advice Group, a collection of Advisory Firms all over Australia that separates financial advice from financial products as their preferred approach to deliver financial certainty for clients without any conflicted product payments. As an author, blogger, columnist, and keynote speaker, Jim is regularly called upon for his professional insights into the advice industry. His latest book is Seeking Certainty.