I love the bush.

I reckon it has something to do with my four grandparents being raised in NSW’s central west.

It never ceases to amaze me how much I enjoy touring on unmarked open country roads with windows down and the elements whooshing in. Even when it’s cold and raining – yeah, weird.

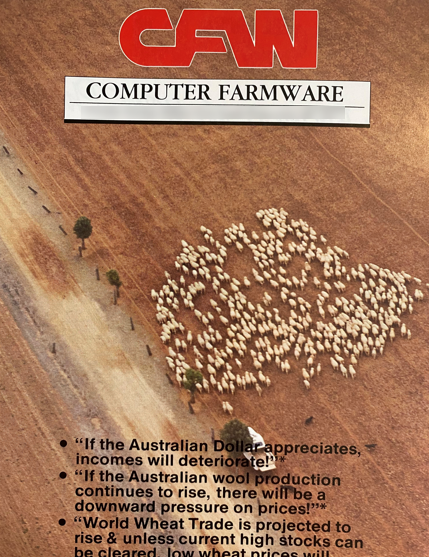

Growing up a city kid, after six years selling clunky computer systems in Sydney’s booming early 80’s marketplace, I had a crack at building a computer business in the bush.

I travelled thousands of country roads in search of a different route. I gave presos in showgrounds, clubs, small halls and smaller schools and on a few kitchen tables. I got lost looking for the eleventh gate past a non-descript bend in the road. I met many generous and open people dotted over NSW going farm to farm with my chunky software and awkward green screen, twin floppy computer systems.

For all the touring, hospitality, towns, and people, I made no money.

Unfortunately, no amount of enthusiasm for my solutions could ignore the fact that the margins were in the hardware, no matter how fancy my software was that managed cash flows, diary rosters, breeder records, or tracked ear tags.

It has been the same for financial advice.

THE FUTURE

Today’s financial advice is dominated by similar thinking to 1980 computer purchasers when hardware margins drove the industry and purchase decisions.

In the 1980s people bought an IBM PC on similar reasoning clients buy Macquarie or any of the bank’s cute ads promising a better lifestyle, but delivering products designed to perennially clip away at hard-earned funds.

When the margins are massive, the management is sharp, and marketing is emotionally charged, the ‘hardware’ firms easily dominate the purchase narrative and own the market power.

Thankfully, free markets hate imbalances.

Towards the end of the 1980s, the computer hardware makers lost the inevitable margin squeeze and were replaced by new technology giants supplying communication, cloud and app solutions.

Thanks to the billions of dollars pouring into Australia’s superannuation funds every day, the success formula for financial product providers is being squeezed. The rent-seeking opportunities provided by long-term guaranteed superannuation flows, don’t just attract global competitors, but constant structural reform and demand eye-watering investments in technology.

Meeting new regulatory benchmarks, controlling compliance costs, fees becoming more transparent, and finding opportunities for gigantic funds to out-perform eventually changes the product game forever. So much so that the inevitable is occurring as questions arise regarding the long-term valuations of funds without gigantic balances.

History has traced this story before from early eras of industrialisation from the cotton mills to the steel makers, to the railway builders, to the telecommunications giants and the computer hardware firms who have all travelled poorly once on the downside of their evolution.

So now the financial hardware providers are entering an evolutionary contraction phase brought about by many decades of success.

Where are the opportunities as the fund giants (i.e. the financial hardware providers) appetite for growth turns competitors into takeover targets?

Not in the crypto market, but in the industry that has just witnessed one of the greatest rates of resignations – the advice industry.

Provided it can re-connect.

THE OPPORTUNITY

Until recently, I was unaware of the new Generation C.

Unlike Baby Boomers and Millennials, it seems Generation C are identified more by their ‘connectivity’, rather than their ages.

While ironic in an era that will be forever remembered by Covid’s disconnection, connectivity’s currency within Generation C’s networks is being “click-worthy”, however fake, insular or genuine the connection may be.

We’ve seen examples of Generation C’s power and how it has accelerated the shifting of some entrenched political mountains and also enflamed astounding debates.

What seems certain is the rise of Generation C as a greater force of both good and bad connectivity on headline issues of climate change, racial discrimination, immigration, biotechnology, retirement, urbanisation, health care reform, energy reform.

The inevitable consequence will be a growing personal uncertainty as new labels of ‘fake’ and ‘not-fake’ battle for their own click-currency.

THE ADVICE GAP

The new connectivity with its currency of clicks is like a road system.

But unlike our road system with known and respected boundaries that allows safe travel, the connectivity road system circling our lives has patchy and infantile boundaries needed to protect the common good and progress of all users.

This creates an advice gap between the needed boundaries of best interest and today’s reality of free-flowing connectivity distributing impartial, biased or fake narratives.

Compared to the last few decades when the future of advice was a function of distributing a manufacturer’s product, the future of advice is addressing the advice gap.

It is a huge responsibility and an equally monumental opportunity both for those seeking and delivering advice.

Addressing the gap is about increasing confidence – the ultimate test of advice that serves the greater good.

Back in the outback, the ‘bush telegraph’ filled a type of advice gap.

It was a form of connectivity for the greater good well before the social media empires or telecommunications groups before them. The bush generation needed their neighbours much more than the city-dwellers to address and at times, survive, the challenges of seasons, misfortune, ill health, fire, plagues, law enforcement, education, and isolation.

It also engendered a sense of belonging to something so much bigger than its past.

That is the role and opportunity for the advice of the future.

What do you reckon?

Photo credit:

ABOUT JIM STACKPOOL

For over 30 years, Jim has influenced, coached, and consulted advisory firms across Australia. His consulting firm, Certainty Advice Group coaches, trains and builds advisory firms delivering comprehensive, unconflicted advice, with fees priced purely on value. He is growing a strong and collaborative community of advisory firms aligned on Australia’s only Certification Mark advice standard for comprehensive, unconflicted advice – Certainty Advice. He has authored four books regarding financial advice with his latest – What Price Value – available now since release in March 2022.