I firstly obtained a gliders license in an old Blanik soaring above Narromine in 1980.

I qualified for my private fixed-wing pilot license in 1984 at Camden airport when paddocks and chicken sheds still surrounded it, and later a commercial helicopter license in Castle Hill before the gentrification of Sydney’s Hills district.

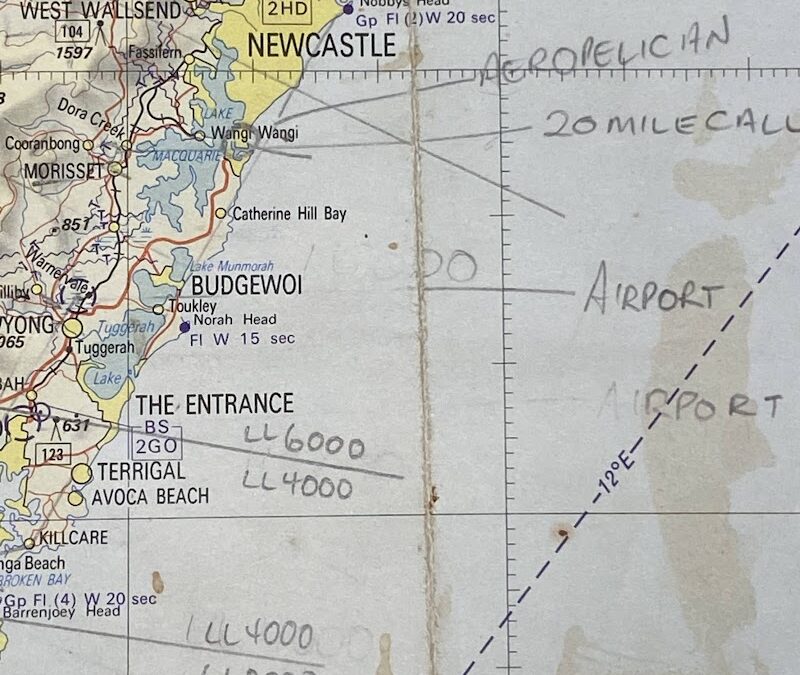

I still enjoy the scanning and planning of world aeronautical charts to determine where and how the next flight will go.

While not every flight needs a plan, when flying to, over or near somewhere different, new, busy or restricted, taking off without a plan is dangerous and often illegal.

Not so in our financial lives, as most Australians continue to fly through their financial lives without a valued plan.

The fifth element of an ideal client is their alignment, commitment, and management to a financial life plan.

Fundamentally, ideal clients take and act upon advice provided in an advisory relationship.

TAKES ADVICE

What does taking advice mean?

Financial planning and taking advice mean different things to different people. The terms don’t just confuse the people seeking advice, but the people delivering advice, planning and financial products.

The confusion arises because the advice is still in its infancy and operates with some infantile, ridiculous and out-of-date definitions.

For instance, many Australians who believe they have a ‘plan’ are more probably holders of an out-of-date compliance document designed to protect the risks of the supplier rather than showing precisely how the value they hope for will be achieved.

There has been progress in advancing the advice industry, but it has been circuitous.

The current review by the Australian Law Reform Commission is a powerful initiative. But it will require herculean resolve politically and procedurally to re-draft Australia’s Corporations Act.

Future regulatory and political agendas will be unpredictable and biased, but the path ahead for most Australians seeking advice is just that – a path.

PATHS NOT PRODUCTS

Most progress in life requires a path, showing clear forward steps and a clearer reason to proceed.

Plans are needed when paths diverge, meet an obstacle, become circuitous or start to go backwards.

Unfortunately, in today’s infantile financial advice industry, plans are synonymous with financial products, not financial paths.

While financial products can sometimes be valuable vehicles for stages of financial paths, not all paths need financial products.

Crucially, a financial path cannot be influenced by a financial product. Client options are compromised when paths are bent out of shape by any incentive for a product provider.

Fundamentally, an ideal advice client is a client that commits and aligns to a forward path built with their advisory team.

IDEAL?

I was recently helping a client review her firm’s client base.

Her most significant client was bullish on property investments with a long history of good and bad decisions.

Fundamentally, her client was still buying and selling property ignoring her advice to diversify.

I asked her if this was the standard behaviour of her ideal clients.

“This family is my firm’s largest client. Of course they are ideal”.

I still can not understand how the property-obsessed client could be ideal if their actions and their adviser’s recommendations are not aligned on an agreed forward path.

Plato taught us centuries ago that the cure of a part should not be attempted without the treatment of the whole.

This is fundamental for ideal advice clients – they take advice on the whole path, not just the parts they are comfortable with.

Until they don’t.

CHECKING OUT

No matter how good or how long, most financial paths encounter a bridge too far.

Clients opt-out.

No matter how much clients have valued the leadership, advice, relationship, progress, and returns achieved, there usually comes a time when the motivation to continue on their advisory path is less than the perceived value of further guidance.

They seek something different, cheaper, or possibly easier.

Retaining clients who decide not to align to their best financial paths is the biggest challenge facing advisory teams attempting to build prosperous firms.

Not wishing to ‘lose’ loyal clients and revenue, the reaction of many firms is to accommodate their former ideal client’s request by reducing prices and justifying their actions by reducing services.

SERVING THE NON-IDEAL

This is the moment in ideal client relationships when the client/adviser roles shift.

The client has now become the adviser dictating to the adviser what they believe they want rather than what their adviser believes they need.

At this moment, they cease being ‘ideal’.

Worst of all are the long-term ramifications for advisory team productivity.

Advisory teams complaining about ‘lack of time’ are really complaining about the lack of productivity caused by attempting to provide too many services to too many clients for too low a return.

The problem isn’t a lack of time, it is a lack of confidence to focus on ideal clients who will value and fund the progress of their future.

FOCUS

Post covid, post-election and past much of the recent regulatory reform, the advice industry is at a unique milestone, providing never seen before opportunities.

However, it takes focus and tough decisions to realise the opportunities.

Adviser numbers have declined, and financial advice is in growing demand as uncertainty increases.

Advisory firms can not afford to lose their focus on who their ideal advice clients are.

The best paths for most advisory firms are paved with clients that ‘take advice’.

Advisory teams need plans that provide the path, the accountability and the returns their ideal clients value.

These paths will create prosperity for both clients and advisory teams.

Flight paths are changing all the time, but no professional pilot would be flying without one.

What do you reckon?

Next Blog: What Makes an Ideal Client – Part 6 (of 6) – They Pay

Photo credit: JJS_WheresAeroPelican

ABOUT JIM STACKPOOL

For over 30 years, Jim has influenced, coached, and consulted advisory firms across Australia. His firm, Certainty Advice Group coaches, trains and is building a growing group of advisory firms delivering comprehensive, unconflicted advice, priced purely on value. The community of advisory firms aligns with Australia’s highest and only ACCC/IP Australia Certification Mark standard of comprehensive, unconflicted advice – Certainty Advice. He has authored four books regarding financial advice with his latest – What Price Value – available now in pre-release since launched in March this year.